Adobe Scraps Its $20 Billion Takeover of Figma & Why Didn't It Happen?

Adobe will pay a $1 billion breakup fee to the design software maker, amid greater antitrust scrutiny of mergers.

-

Adobe Agrees to Buy Figma in $20 Billion Software Deal

-

Figma for 20 billion. A story about the difficult reality of building a startup and the myth of overnight success.

Adobe will abandon its $20 billion takeover of the design software maker Figma, the two companies said on Monday, bowing to growing regulatory opposition to the deal on both sides of the Atlantic.

Under the terms of the now-scrapped plan, Adobe will have to pay Figma a $1 billion breakup fee.

The announcement is the latest sign that government campaigns to more aggressively scrutinize mergers are having some successes.

Announced last fall, the transaction was meant to give Adobe, the maker of widely used software like Photoshop and Illustrator, control of a fast-growing provider of collaborative design software. The deal’s price tag was twice what the privately held Figma had raised in its most recent fund-raising round, underscoring how badly Adobe wanted a foothold in the sector.

But the planned combination drew concern from antitrust regulators in the United States, the European Union and Britain over whether it would reduce potential competition.

While the companies have argued that they largely do not compete — except for one Adobe product that hasn’t gained much traction — regulators said the takeover could forestall future rivalries and lead to higher prices for consumers. (To some, it appeared similar to deals like Facebook’s $1 billion takeover of Instagram, which critics said stymied the rise of a competitor to the social network.)

“It is important in digital markets, as well as in more traditional industries, to not only look at current overlaps but to also protect future competition,” Margrethe Vestager, the head of the European Commission’s competition policy, said in a statement on Monday.

Early Monday, ahead of its decision to scrap the deal, Adobe called concessions proposed by Britain’s Competition and Markets Authority “disproportionate.” The European Commission was set to weigh potential remedies soon, and Adobe had been awaiting a decision by the Justice Department on whether to sue to block the deal.

Monday’s announcement was an admission that the companies were unlikely to overcome those objections, and would have had to spend months fighting regulators in court in three jurisdictions.

“Adobe and Figma strongly disagree with the recent regulatory findings, but we believe it is in our respective best interests to move forward independently,” Shantanu Narayen, Adobe’s chair and chief executive, said in a statement.

Dylan Field, Figma’s chief executive, said in an interview that “ultimately there is a gap between how regulators understand our business and how we understand our business.”

It became clear in recent weeks, he added, that the path to approval was narrowing, and abandoning the deal would provide more certainty to both companies’ employees and customers.

Shares in Adobe were up 2.5 percent in afternoon trading.

The decision is another win for tougher antitrust enforcement: A day earlier, Illumina, a big gene-sequencing company, said it would sell the cancer test maker Grail, which it had bought for $7 billion, after an appeals court endorsed the Federal Trade Commission’s argument that the union would “substantially reduce competition.”

(Like Adobe, Illumina argued that it did not compete directly with its takeover target, a claim that regulators rejected.)

Antitrust regulators also saw some stinging defeats this year. Most notable was Microsoft’s $69 billion takeover of the video game giant Activision Blizzard; that deal closed in October after drawing objections from the F.T.C. and Britain’s Competition and Markets Authority.

Last year, Adobe announced it had entered a definitive agreement to acquire Figma, the newest leader in web-first collaborative design, for a total of $20 billion.

On Monday, Dec. 18th, Adobe decided to terminate its acquisition after hitting several regulatory roadblocks in the UK and EU. Figma CEO, Dylan Field, commented on the decision, saying the two companies “no longer see a path toward regulatory approval” which is why the deal was shelved.

Keep reading to see why this acquisition mattered and what’s next in the world of collaborative design.

What is Figma?

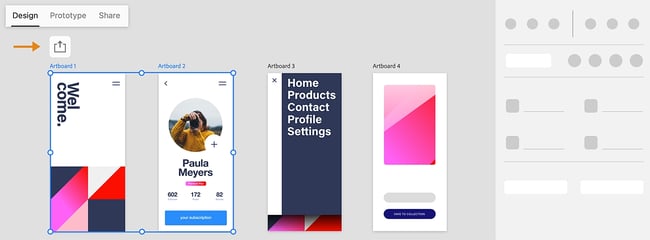

Figma is a cloud-based design tool with collaborative features. With Figma, multiple designers can work in one online space. These designers can also collaborate more easily with clients on the platform.

Founded in 2012 by Evan Wallace and Dylan Field, Figma is an effective collaborative design tool with a scalable developer ecosystem. It’s easy to use, comes packed with design tools that every developer needs, and makes work easier for remote teams.

Figma runs on any computer, allowing users to collaborate across various platforms. Teams can share the same designs between PC, Mac, or Windows.

The browser-based interface is similar to collaborating in Google Docs in real-time, with clickable avatars highlighting what other users are working on. This helps avoid the dreaded design drift and keeps teams on the same page, figuratively and literally.

With remote and hybrid work proliferating, Figma gained significant popularity during the Covid-19 pandemic. Now, its products are used by over 4 million designers around the world.

Figma raised nearly $333 million from investors. Big-name venture investors include Index Ventures, Founders Fund, Andreessen Horowitz, and Fuel Capital.

The company’s last round of funding led by Durable Capital Partners ended in a valuation of $10 billion, a far cry from the $20 billion that Adobe planned to pay for it.

Inside the Adobe Bid

Although Figma has yet to establish itself as a clear competitor against design giant Adobe, it's expected to gain a total market share of $16.5 billion by 2025.

Meanwhile, Adobe continues to grow its suite of products, however, Adobe XD’s offering with features most similar to Figma has not been a highlight of its income.

Digital Media revenues grew about 13%, with revenues increasing to over $3 billion, while Creative Cloud generated about $2.63 billion. Document Cloud grew 23%, and Experience Cloud subscription revenues topped $981 million last year.

Why Adobe Wanted Figma

Adobe’s core business growth has been slowing, as new generations of design tools water down the market. So, Adobe had many reasons to consider the acquisition of up-and-coming Figma.

This acquisition enables Adobe to grow through another avenue where it has yet to see success. Its design product Adobe XD has not been as popular as Figma’s offering, and Adobe has not invested as much development into the product as its other tools.

Figma’s UI/UX collaborative design tools offer a more shareable experience, an area that Adobe lacks.

The Figma acquisition also ensured solid profitability for Adobe. Figma boasts a 90% gross profit margin and a 150% net dollar retention rate, some of the best numbers in the industry.

Still, the extra cash flow would have also enabled Adobe to develop new features, offer better customer experiences, and improve its business models overall.

Plus, Adobe has been looking for new ways to extend its cloud platform. Many of its tools are only offered as local software until fairly recently. But with huge consumer demand for web-based experiences, the acquisition of Figma would have put them in a position to gain even more market share.

Forrester senior analyst Sheila Mahoutchian said that Adobe was “late to the game” when it comes to enabling full-featured, browser-based, real-time design tools.

Plus, Figma has already made its way into the tech stack of companies such as Kimberly-Clark, Microsoft, Airbnb, Salesforce, and BP.

“Figma’s best-in-class collaboration workflow platform has changed the landscape for design tools, moving the design world from individual contributors to collaboration-based team enablement,” said Mahoutchian.

The Bid

Adobe agreed to acquire Figma for $20 billion, half cash and half stock. An additional 6 million restricted stock units would also be granted to the CEO and employees of Figma that vest over four years after the deal closed.

Dylan Field, co-founder and CEO of Figma, would continue to lead the Figma team while reporting to the president of Adobe’s Digital Media segment, David Wadhwani. Each company would continue to operate separately until the tentative close in 2023 after regulatory and stockholder approvals.

This would have been the largest bid that Adobe had made to acquire an existing company. The second largest acquisition was Marketo, worth $4.75 billion in 2018. But why pay $20 billion for a company only valued at $10 billion?

Although it will likely be several years before Adobe sees a boost in its annual earnings from acquiring Figma, sales growth is expected to accelerate immediately. Figma would have also given Adobe a larger platform with deeper reach in hybrid and remote work niches.

If Adobe could have avoided logistical issues and unexpected problems that commonly arise during mergers and acquisitions, this purchase would have delivered substantial returns for investors and the organization.

Why did this deal fall through?

Earlier in 2023, the UK’s Competition and Markets Authority (CMA) launched an investigation into the acquisition and “found competition concerns” that were used to block the deal from being made.

The CMA wanted Adobe to sell off Figma Design after completing the acquisition, which is the core product that Adobe wanted to purchase from Figma in the first place. The two entities went back and forth for months, but the CMA didn’t budge.

Then, in August, the European Commission released a statement regarding its decision to investigate the merger based on its “concern that the transaction may reduce competition in the global markets for the supply of interactive product design software” — a fancy way of saying Adobe would have too many hotels on the board and would be closing in on a monopoly over the design software market.

And to make matters worse for Adobe, the DOJ launched an investigation, too. But, since it was a little late to the party, it wrapped things up by giving the EU and the UK a pat on the back after the merger was struck down.

In short, Adobe and Figma saw that the odds were stacked against them and rather than pushing through a sea of red tape, they were better off walking away from this deal.

What does this mean for Adobe?

For starters, Adobe will have to pay Figma a termination fee of $1 billion. But, that’s really just the tip of the iceberg.

This is a huge missed opportunity for Adobe. Figma has grown tremendously over the past few years — around 77% of UI designers use it as their preferred design tool. We even use it here at HubSpot. It’s expected to have a total market share of about $16.5 billion by 2025.

With this acquisition, Adobe would have added another powerful tool to its suite of creative design products. It would have also removed a major competitor from its marketplace, giving Adobe even more control over its industry. Losing out on this deal means Adobe will still have to compete with Figma over a key portion of the product design process.

Adobe plans to continue its partnership with Figma going forward, according to Wadhwani.

What does this mean for Figma?

Sure, Figma gets a nice consolation prize of $1 billion, but it loses out on the chance to merge with a software giant like Adobe.

When the deal was announced, Figma was valued at about $10 billion, and Adobe was willing to double that valuation with its $20 billion bid. Figma is growing year over year, and Adobe would help it scale its operations to a whole new height.

Figma is still in a good position, however. Since it produces such a high gross profit margin and retention rate, the company is still making money off each customer and usually retains them over time – a winning formula for any business.

For Figma, the plan is likely to stay the course and keep its name in the conversation with players like Adobe. It'll either continue to grow over time or regulations may loosen to the point where it can get another deal done.

Was this the right move for Adobe?

Many analysts agree that this would have been a stellar move for Adobe to position itself as a market leader as the world of work and digital experiences continues to evolve.

Adobe also has a successful history of acquisitions that include big sellers like Photoshop, Macromedia, After Effects, Omniture, Marketo, and Magneto. All of which have contributed to the growth and persistence of the graphic design powerhouse.

Professional designers of today require more advanced collaboration capabilities, simple prototyping, and untethered shareability, all of which they can have with the help of Figma. And while Adobe provides the foundation for digital designers, its desktop-bound tools simply won’t cut it.

Limited communication makes innovation slow and reworks inevitable. But real-time web-based collaboration solves those problems. With this move, Adobe would have been able to offer designers the tools they needed to succeed in an increasingly cloud-based environment and collaborate effectively with non-designers.

Why It Matters

The Figma acquisition raised many questions about how designers would work with Adobe, whether or not they would have to switch from a Figma account to an Adobe account, pricing changes, and usability.

Before the world of digital-first innovations, tech tools were siloed into very limited accounts, with only a few features for each design tool. This required designers to own several software tools to create, deliver, format, and collaborate with their peers.

Designers who were assigned a deliverable to create typically would have to go off on their own, create it, and bring it back to the client as a final deliverable.

Now, deliverables are assets that evolve and change as quickly as changing customer sentiments on the other side of the equation. There is a shift in the user experience arena toward shorter timeframes and more input from various stakeholders. Designers must carefully balance stakeholder requirements with customer needs in rapidly evolving industries.

Today’s design firms want to drive most of a brand’s interactions through digital experiences rather than price differentiations across the market. But these rapid design changes can’t happen overnight unless disparate teams can collaborate on designs in real-time.

That’s why this acquisition was so important.

Adobe has been a leader in graphic design since its inception in 1982. But its per-device nature no longer meets the expectations of design teams. Figma, on the other hand, offers designers a first-class experience with full design features, collaborative abilities, and shareability, all in real-time, right from your browser.

Figma’s cross-functionality makes it easy to share designs with stakeholders and decision-makers and get their input without having to track down emails. If these two companies combined, designers could continue using time-tested Adobe tooling with the added benefit of Figma’s cloud-based qualities.

Experts Weigh In

Some experts weren’t so sure that the acquisition would have had as big of an impact on the design space as others seem to think. According to IBM’s distinguished design executive Oen Michael Hammonds, investments like this happen frequently, and if it weren’t Figma nipping at Adobe’s heels, it would be another organization.

“Designers need to be resourceful and growth-minded when these tooling shifts happen. They happen a lot,” Hammonds says. “Either next week, next month, or a year from now, someone else will come out with the next best UX thing, and this cycle will start over again.”

Other experts can’t help but wonder if the acquisition would have limited the creative prowess that Figma has displayed.

“There’s a chance that Figma will not continue to develop at the rate that it has been, or that Adobe will force-fit it into their ecosystem like a square peg in a round hole,” says Tony Brinton, founder and principal at Brinton Design.

Some UX designers, like Laura Fields, were happy the deal fell through. She felt the company didn’t need this merger to be successful.

Others were disappointed, like Design Evangelist Howard Pinsky, who has used Figma for years.

What Designers Need To Know

In my opinion, Nisha Swarup, CEO of Airfilp, summarizes it best:

With fewer market powers comes less innovation over time and higher prices for consumers because there is less competition. On the other hand, by integrating these two powerful technologies, we would have opened the door to a world of new possibilities generating even more value for the buyer.

Many design firms require their designers to have Adobe certifications that prove their competency in certain design areas. But the usefulness of the legacy suite of design tools is dwindling in an industry that depends on collaboration to realize successful outcomes.

Users know that Adobe is prone to put an acquired product on center stage, meaning that Adobe would have been pressured to put XD aside while the company focused on the Figma release.

As Adobe integrated features into Figma’s platform, it would have strengthened the offerings of both platforms. However, this likely would have come at a higher overall cost to the user, making Adobe even more of a premium product in this space.

What's Your Reaction?

![[VIP] DesignCode: Build Beautiful Apps with GPT-4 and Midjourney](https://design.rip/uploads/cover/blog/designcode-gpt4.webp)

![[VIP] AppCoda: Mastering SwiftUI - Professional Packet (Updated 04.2023)](https://design.rip/uploads/cover/blog/appcoda-mastering-swiftui-professional-packet-worth.webp)

![[VIP] AppCoda: Beginning iOS Programming with Swift (Updated 04.2023)](https://design.rip/uploads/cover/blog/appcoda-beginning-ios-programming-with-swift.webp)

![[VIP] Whoooa! 156 vector Lottie animations](https://design.rip/uploads/cover/blog/whoooa-156-vector-animations.webp)